Por: Tatiana Gélvez Rubio, Carol Martínez Algarra y Joel Grimaldos Valero*

In 2021 the OECD proposed a global agreement to ensure that large companies pay a minimum tax rate of 15%. This proposal is part of the strategies for Global Anti-Base Erosion. The initiative aimed to deter profit shifting and fight tax evasion, enhance competitiveness, broaden the tax base, and ultimately support long-term investments while ensuring benefits for future generations. Tax avoidance has been a large-scale problem worldwide, just to give a broad estimate, the IMF in 2019 reported approximately between 500 to 600 billion dollars in losses per year (Crivelli, Mooji and Keen, 2015; Cobham and Janský, 2018). This represents around 3.2% of GDP in OECD countries (Buehn & Schneider, 2016)

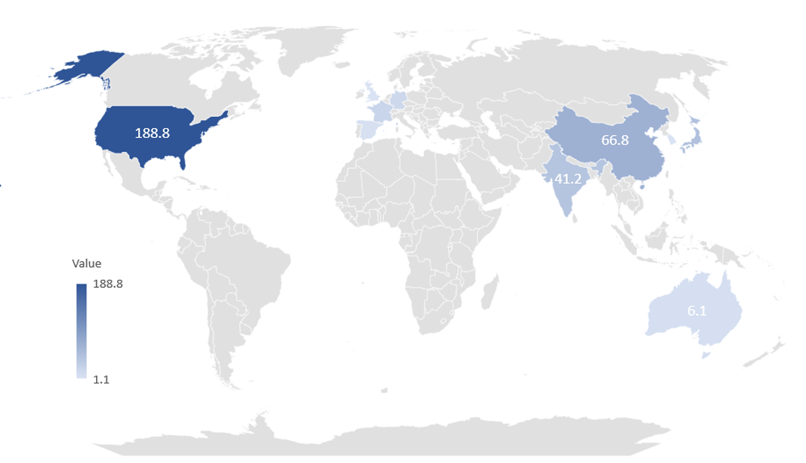

Some countries, including the United States, China, Japan, and European countries, are at the top of these figures, as depicted in the map below. This clearly shows that the problem has a worldwide scale of concern.

Estimated annual corporate losses for tax avoidance (Billions of dollars)

|

United States |

China | Japan | India | France | Germany | Australia | Spain | South Korea | United Kingdom |

| 188.8 | 66.8 | 46.8 | 41.2 | 19.8 | 15 | 6.1 | 5.5 | 1.1 |

1.1 |

Source: Own elaboration based on UNU-Wider statistics (2017)

According to the OECD, 137 countries that comprise over 90% of the global economy will join this agreement beginning in 2024. The countries within the European Union have agreed to implement the minimum tax across the entire bloc of 27 nations, with the implementation details set to be determined in December 2023.

The agreement focuses on two main features:

- Redistribute part of the tax burden of multinational enterprises to the countries where they operate and generate profits, even if they do not have a physical presence there.

- Entails the establishment of a global minimum tax that all multinational enterprises must pay, regardless of their location.

This proposal emerges amidst a transformation in the global market following the pandemic. Currently, an increasing number of companies derive their income from intangible sources such as patents, software, and intellectual property rights, driven by the growing process of digitization including large companies such as Google and Amazon. Additionally, governments are seeking to reduce the practices of multinational corporations shifting their profits and tax revenues to countries with a lower tax base.

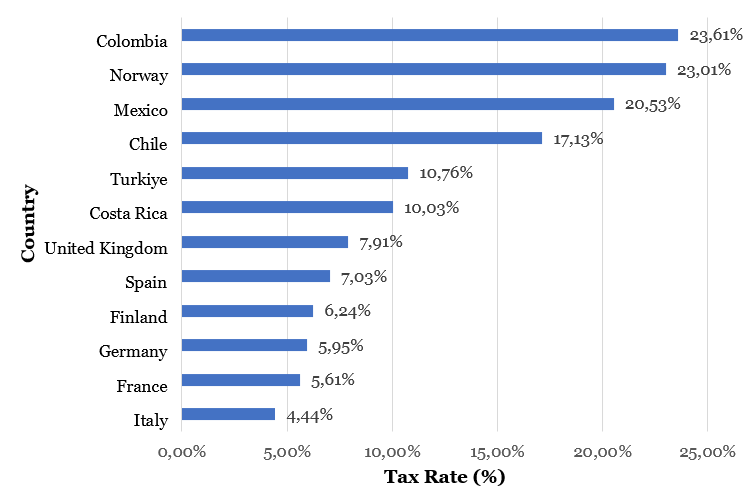

Share of taxes (%) on company profits

Source: Own elaboration based on data OECD (2021)

The minimum tax aims to curb extensive tax competition among governments seeking to attract foreign investments. For instance, if a country with a global minimum rate of 15% hosts a company that earned profits abroad and was taxed at 5%, it would have the authority to ensure compliance with the minimum tax by imposing an additional 10% charge. In the case of Colombia, as depicted in the previous graph, it is notable that the country ranked among those with the highest corporate income tax rates within the organization, surpassing countries such as France, Costa Rica, Türkiye, and Mexico. (OECD, 2023)

Preliminary estimations on the minimum tax implementation

Source: Own elaboration base on OECD reports (2023)

Challenges and Consequences of the Global Minimum Tax Rate

Based on the figures presented earlier, it is evident that the United States’ current tax system is heavily prone to present heavy losses from evasion. However, the initiative for a global minimum tax rate did not gain traction in the United States as was rejected by the Congress last year. This refusal can be attributed partly to political interests between different parties and the potential negative implications it may have on large companies benefiting from the existing system. Nonetheless, Joe Biden’s corporate fiscal policy, known as “Made in America” remains steadfast in its pursuit of joining international efforts to establish a more equitable and effective global tax framework, with the minimum tax serving as a crucial pillar of the $2 trillion infrastructure spending plan. As part of this approach, Biden has proposed increasing the U.S. corporate tax rate to 28%, aiming to enhance the country’s competitiveness, improve job compensation, and ensure that the tax code benefits families, workers, and small businesses rather than solely focusing on profitable companies and billionaires.

According to Geiger (2023), the proposals put forth by the United States will reshape the landscape of the debate and have a significant impact on negotiation positions, particularly for countries that will be adversely affected by these measures. Moreover, there remains considerable uncertainty as to whether Biden’s tax reform agenda will overcome obstacles in Congress that fears putting American companies at a competitive disadvantage. Legislative support is crucial for the proposed ideas to establish a global minimum tax and maintain their validity.

From a corporate standpoint, the OECD’s initiative to establish a 15% international minimum corporate tax rate raises concerns regarding operating costs and tax margins for certain large multinationals. While it is not inherently illegitimate for these companies to relocate their headquarters to countries with low or even zero corporate tax rates, such actions raise questions regarding corporate social responsibility.

In line with this idea, Sagués (2015) acknowledges that companies have the right to legally minimize their taxes by relocating their operations to countries with low corporate tax rates. However, this is precisely where the OECD proposal might be limited and potentially not entirely effective, as its objective is to target large companies that engage in such practices and would compel so-called “tax haven” countries to raise or introduce corporate tax rates. A prime example of such a jurisdiction is the Cayman Islands, a British Overseas Territory renowned as a prominent tax haven with a 0% corporate tax rate.

Over the years, this arrangement has attracted numerous companies to establish their operations in the Cayman Islands. As Sandri (2022) suggests, similar situations exist in European countries like Switzerland, where the corporate tax rate ranges from 11.9% to 21.6% depending on the canton. Additionally, tax havens such as Hong Kong and Macao have amassed substantial wealth through the relocation of corporate operations.

Approximately 37% of profits and taxes from large multinationals, primarily of European origin, are estimated to be concealed in tax havens, thereby reducing taxation in their home countries. In summary, if the OECD proposal is approved, many of these tax havens would experience a decline in growth potential, as it would discourage companies from relocating their operations there. Consequently, numerous large multinationals would reconsider moving their operations away from their home countries. While profit margins for these companies would be affected, the implementation of the proposal would promote greater tax fairness and reduce competition among countries in terms of corporate tax rates.

What about the Global South?

There are no doubts that the initiative intends to create more equitable scenarios worldwide, as Stiglitz and Faccio express “the Global Minimum Corporate Tax needs more work”. The author is very critical on the initiative as more industrialized countries assume to have a role as leaders missing that countries-especially in the Global South- have been making progress in their tax rules. For example, the global minimum tax was introduced in Colombia under paragraph 6 of Article 10 of Law 2277 of 2022, which establishes a minimum tax rate of no less than 15%.

While it was estimated that the rules proposed by the Base Erosion and Profit (BEPS) would affect 19 companies in Colombia, currently this tax applies to over half a million entities. According to Páez (2022), a Legal Affairs consultant, this situation highlights the lack of differentiation in the implementation of the measure, as the global minimum tax in Colombia was not designed to be selectively applied to specific groups, particular characteristics, or income levels. Instead, it is indiscriminately applied to all micro, small, and medium-sized enterprises (MSMEs) and multinational corporations alike, contradicting the principles of progressivity and material equality, thus diverging from the OECD’s approach. It is worth mentioning that as of March 2023, the norm faced two constitutional challenges.

In summary, as exemplified in the case of Colombia, it is overly simplistic to assume that countries have not been evolving in their tax systems, and it is unrealistic to expect developed countries to suddenly provide ideal solutions for complex economic problems like taxation. While the agreement may appear to be an appropriate measure to combat tax evasion, its effectiveness will depend entirely on concerted efforts and the adoption of a minimum tax on foreign profits by significant economies. The support of the Joe Biden administration is vital for the progress of the global implementation of this initiative; however, there is uncertainty regarding the decisions that Congress will take on the topic.

The effectiveness of this initiative may be hindered by the need for strong global collaboration and rigorous implementation in each country to avoid trade conflicts and the shifting of tax revenues to countries with lower tax rates and tax havens. Some governments believe that any global minimum tax regime should still allow for an element of appropriate tax competition, especially for smaller nations, to enable them to compete with larger countries that have inherent economic advantages.

____________________________________________________* Tatiana Gélvez Rubio is an Associate Professor in the Faculty of Economics at Universidad Externado de Colombia and holds a PhD in Government from the University of Essex (UK).

Carol Martínez Algarra is a junior researcher in the Faculty of Economics at Universidad Externado de Colombia, Master student in Economics and Politics of Education.

Joel Grimaldos Valero is a student of International Business Management, Centennial College, Toronto-Canada.