Tatiana Gélvez Rubio[1] y Joel Grimaldos Valero[2]

An economic slowdown, contraction in the real estate market, rise in domestic level debt rise, international political tensions such as the ongoing trade war with the U.S.A and a challenging evolving tension in political environment has make that China experiences an unprecedented flow of investment, learn more about it in this article.

China has offered attractive market opportunities for investors over the last two decades. A remarkable GDP growth, a competitive labor force, and the widespread presence of Chinese products in the global market, made that China earned its reputation as the ‘factory of the world’ from the 90s through the first decade of the 21st century and solidifying its position as the world’s largest manufacturer.

As a result of this trade expansion, China has ranked as the second largest economy of the world since 2010 as the country’s GDP grew from $1.2 trillion at the start of the century to nearly $18 trillion by 2021 according to the World Bank data (Aljazeera, 2023). The tremendous potential of the Chinese market has naturally drawn enterprises and investors from around the world, representing 4.6% of China’s GDP in 2005. Since then, these flows of investments have played a crucial role in sustaining China’s economic growth.

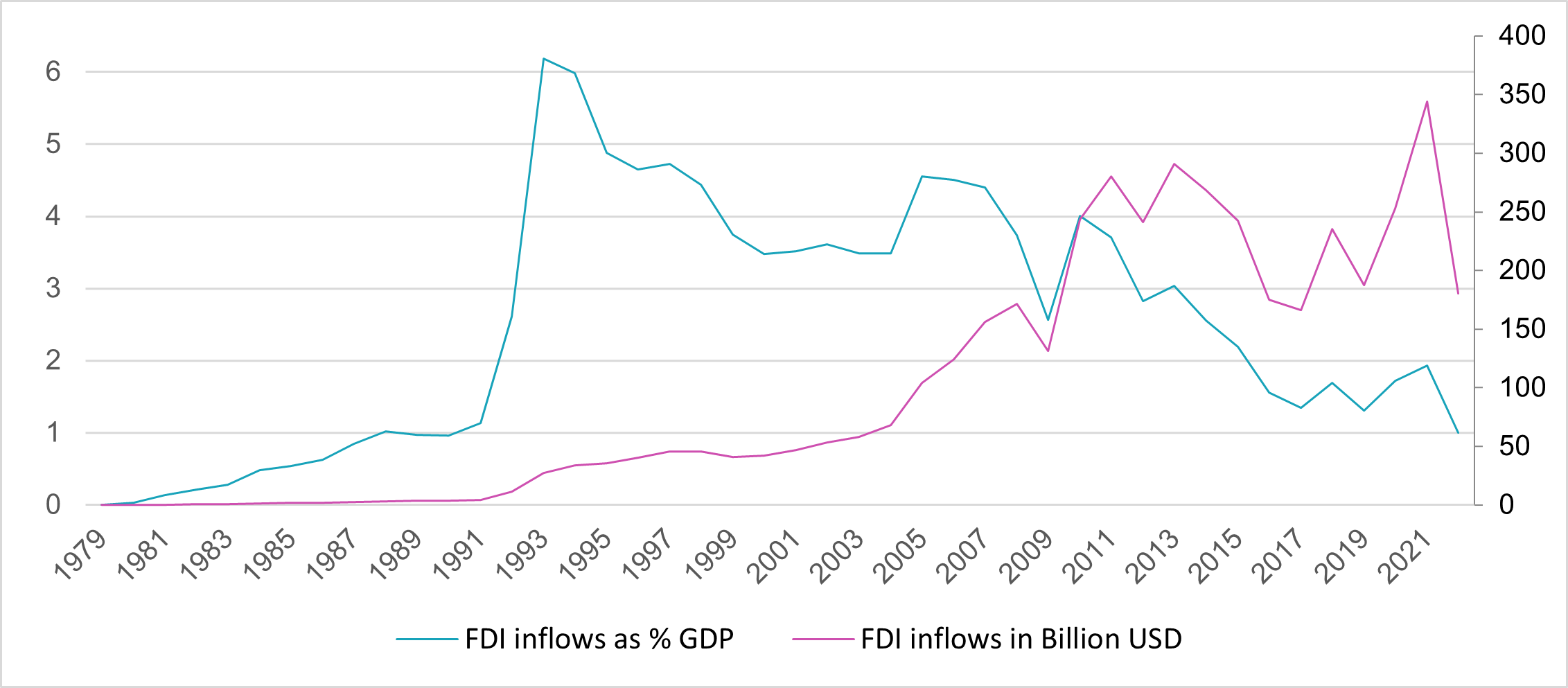

Graph 1. Foreign Investment in China (% of GDP) 1979 -2022

Source: Author´s elaboration based on World Bank data (2022)

However, in recent years, the Chinese government has implemented stringent regulations on foreign investments and the expansion of overseas companies in China. Consequently, an increasing number of investors are now contemplating leaving the country, with many having already divested from their Chinese holdings. As shown in Graph 1, in 2022, foreign investment in China amounted to just 1% of the GDP, marking the lowest level in 25 years, and projections for 2023 suggest it will remain below 1%.

Causes and challenges of Chinese investment exit

There are four main causes for the capital exit of foreign investors from China:

- The decline in Chinese GDP growth, indicating a slowdown in the country’s economic expansion.

- A contraction in the growth of the Chinese real estate market and domestic level debt rise.

- The international political tensions such as the ongoing trade war with the U.S.A.

- The evolving political environment and new economic policies implemented by Xi Jinping’s government.

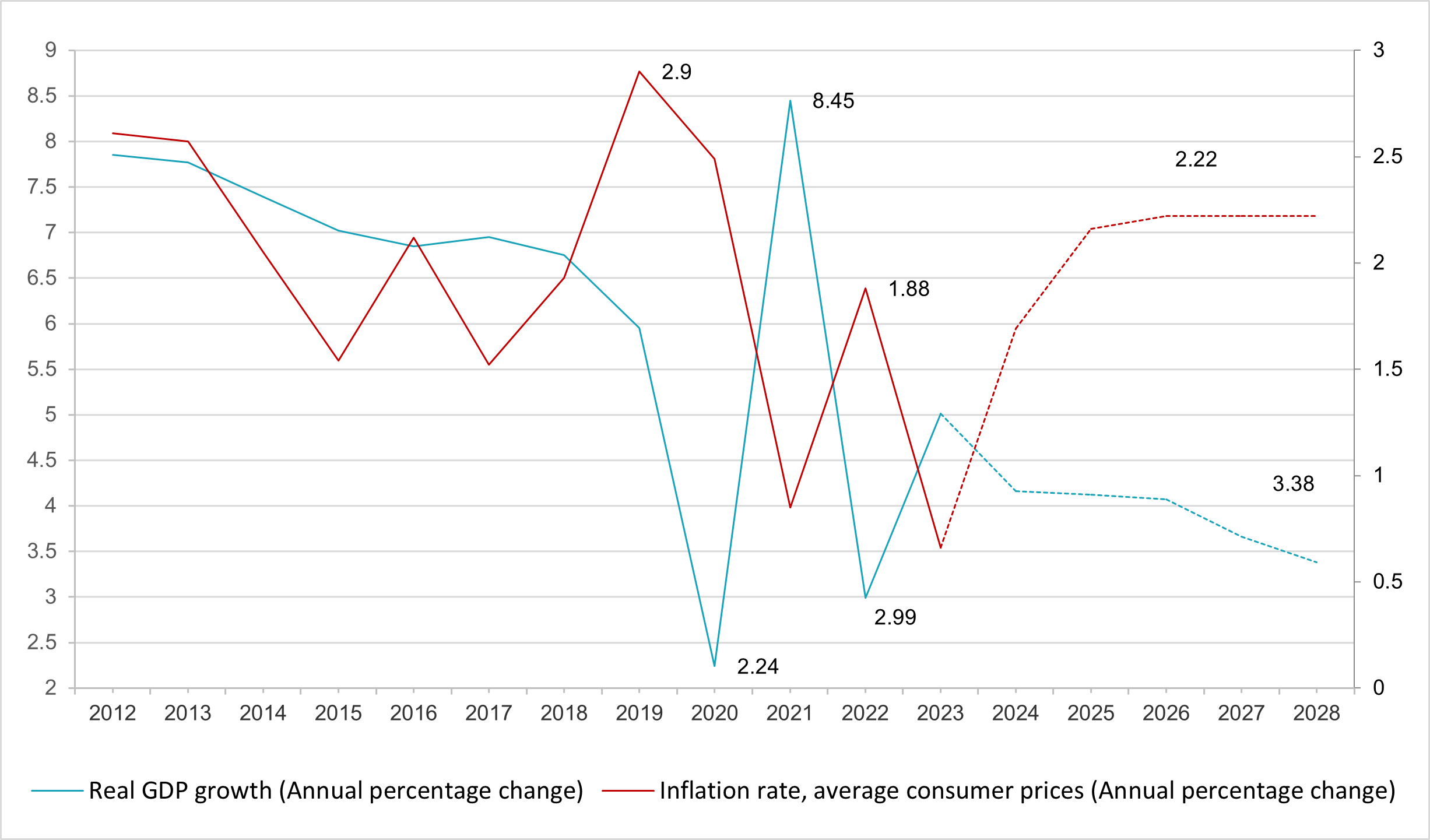

First, the decline of the GDP growth as shown in Graph 2, IMF China’s economic outlook in 2022 its GDP is expected to contract in the coming years, with a reduction of 2 percentage points (p.p.) forecasted between 2023 and 2028. This translates to a decline from the 5.24% GDP forecast for the closing of 2023 to a 3.44% forecast for the closing of 2028.

Graph 2. China’s GDP growth from 2012-2028 (projected)

Source: Author´s elaboration based on World Bank data (2022)

Due international investors create their expectations in the GDP growth projections seeking to maximize their profits, the low country’s economic growth projection appeals unattractive for their aim to seek profits and stability. According to Fortune (2023), the consequences have been noticeable during the first semester of 2023: the unprecedent result of active hedge funds loss of investors, as well as, the decline of direct investment with an annual drop of 87% ($4.9 billion) according to de China´s State Administration of Foreign Exchange.

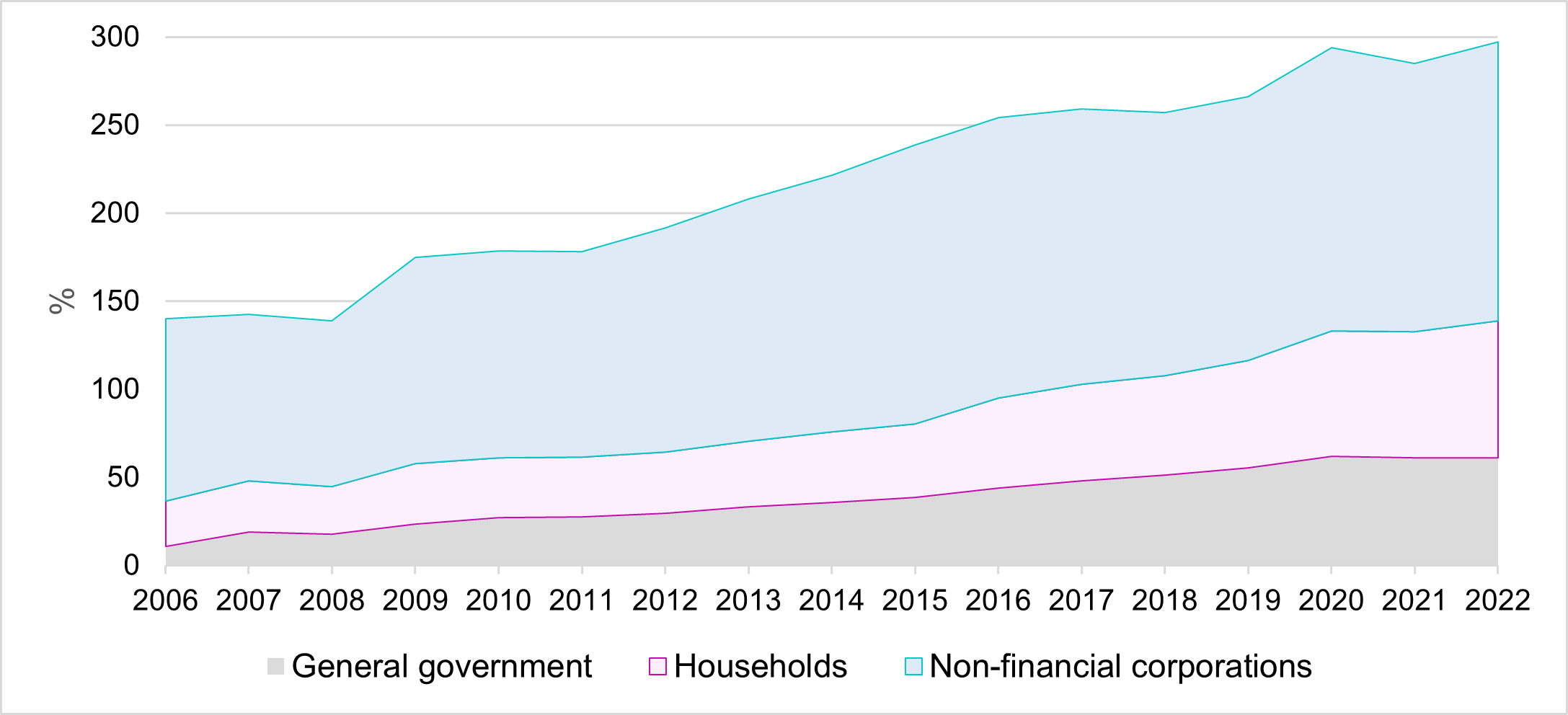

The second cause is the slowdown in the property market, in which the over-construction of buildings in China is creating a slow-motion of the real estate market and is followed by a substantial fall of the steel, concrete, glass, and construction materials demand. As the demand of most of construction raw material, several important steel and cement Chinese companies are having significant losses, and due to the importance in the country’s economy of the construction sector, the impact in the Chinese economy is contracting its growth and had increased the debt-to-GDP. Neumann (2023) mentioned that: “China’s shrinking real estate sector over the coming years will really have a huge impact on heavy industry, on the commodity markets globally, there’s going to be less steel demand. There’s going to be less cement being used — less glass, for example. That impacts within China heavy industrial areas that really produce these raw materials.”

Additionally, internal challenges such as mounting debt levels and a cooling property market have also contributed to the fall of China’s economy. As debt-to-GDP ratios surged, concerns over financial stability have risen, leading to cautious lending practices and reduced investments. Zhou & Tan (2023) explain that: “China’s mounting debt burden has raised concerns over financial stability and has prompted authorities to implement stringent measures to control credit growth, adversely impacting economic expansion”.

Graph 4. China’s Domestic Debt as percentage of GDP (2006-2022)

Source: Author´s elaboration based on Bank of International Settlement (2022)

A third factor is the escalating trade tensions and tariff wars with the United States, resulting in a slowdown in industrial production and eroding investor confidence in the Chinese market. The ongoing trade war with the United States and other geopolitical conflicts have raised concerns about potential economic repercussions and the risk of getting caught in the crossfire of international disputes. This uncertain geopolitical landscape has motivated many investors to explore alternative markets outside of China, Vanderford (2023) explains that: “Geopolitical uncertainties and the risk of being ensnared in international disputes have prompted many investors to seek alternative markets outside of China”.

According to Rappeport (2019) this situation has been sound with the international markets: “The escalating trade dispute with the U.S. has created a ripple effect in China’s economy, leading to reduced investment and manufacturing activity, which has hindered the country’s growth prospects”. Furthermore, persistent economic disputes between countries are placing an increasing number of private sectors at financial risk, significantly reducing imports from China to the U.S. and other important markets like Japan. To illustrate the situation Lynch (2023) indicates that “Chinese products now make up roughly one out of every six dollars Americans spend on imports, down from nearly one in four before the pandemic.”Top of FormBottom of Form

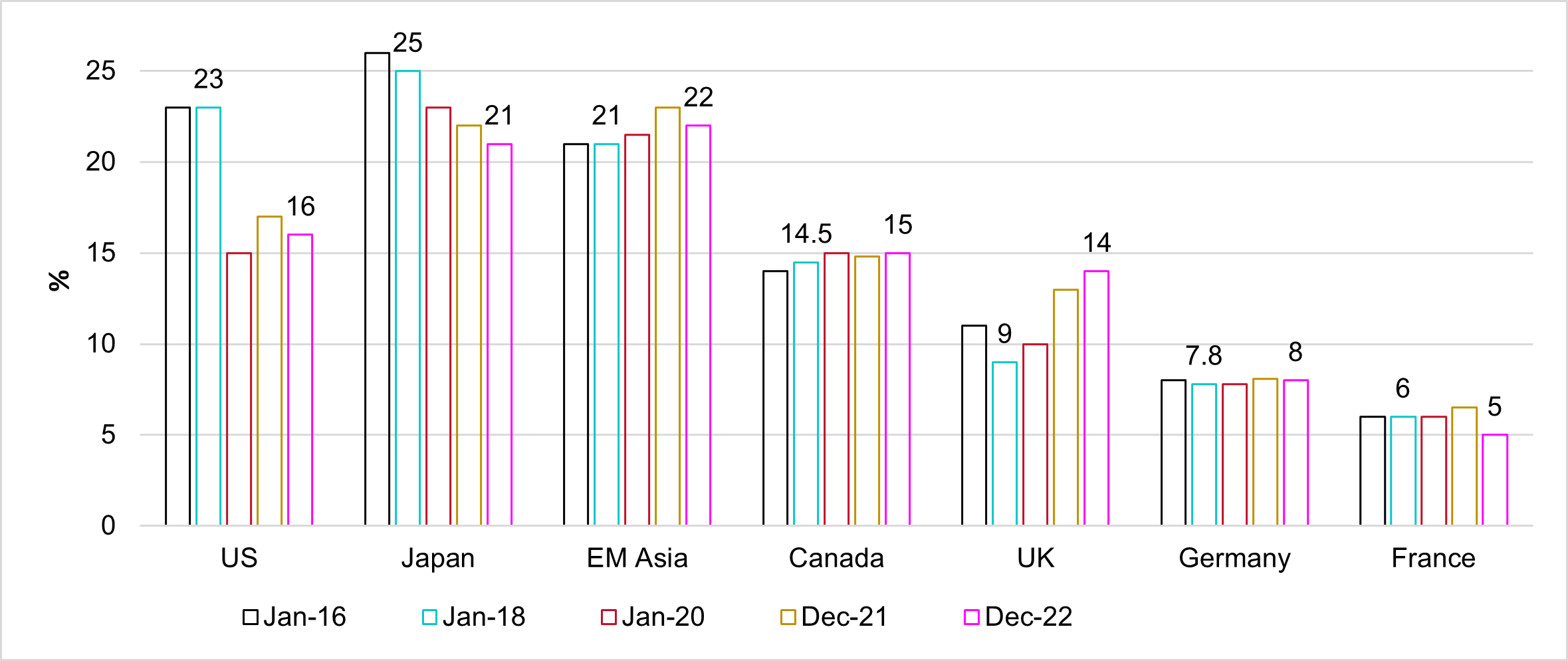

As shown in Graph 3, Lynch also mentions that some Chinese companies have relocated outside of China to evade U.S. tariffs, while others send their products to third countries for additional processing, obscuring their Chinese origins. According to the Census Bureau of China, exports to the U.S. decreased by 24% in the first half of 2023 compared to the same period the previous year.

Graph 3. Western countries import rate from China 2016-2022

Source: Author´s elaboration based on Lynch (2023)

Finally, the change in the political context matters as intertwined with ongoing tensions in China and its new economic regulations, further impacts investment decisions. A key driver behind this exodus is the escalating political and regulatory risks that have emerged in recent years.

The Chinese government’s stringent crackdown on various sectors, such as technology, education, and real estate, has raised concerns about unpredictable policy changes and the imposition of punitive measures, Hancock (2022) summarizes the situation as follows: “The continuous tightening of regulations in sectors such as tech, education, and real estate has made investors wary of the Chinese market’s prospects and has prompted them to reassess their investment strategies.”

Another significant factor contributing to the departure of investors is the lack of transparency and limited access to information in China. The country’s opaque legal system and inadequate protection of property rights have created an uncertain and challenging business environment. Investors have found it increasingly challenging to navigate the legal landscape, leading to a lack of confidence in the safety of their investments. As noted in a Financial Times analysis, ‘Investors feel that navigating the legal landscape in China is becoming increasingly challenging, resulting in a lack of confidence in the safety of their investments’ (Agnew, 2022). Indeed, geopolitical tensions and escalating trade disputes have also played a pivotal role in driving investors away from China.

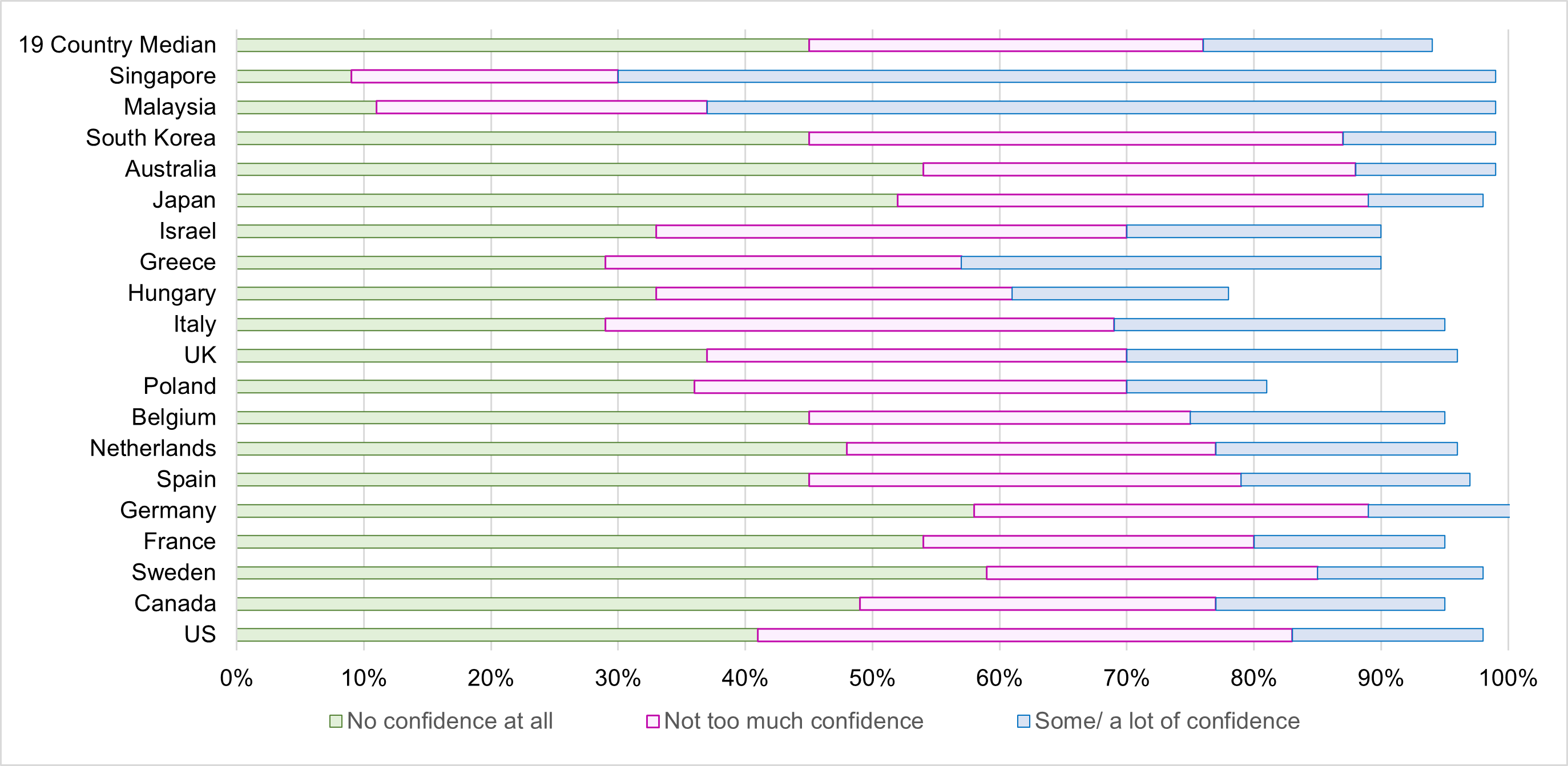

As shown in graph 5, the general trust in China’s leadership by some of the strongest economies has been reduced in the last year, showing the side-effect of the strengthen control over the market by the government. Concerns about government meddling and a lack of a level playing field have prompted demands for more circumspect participation with Chinese markets. As Western investment plans and commercial partnerships with China wrestle with the ramifications of President Xi’s approach to market regulation, this trust imbalance has caused uncertainty.

Graph 5. Confidence in President Xi across Europe, North America

Source: Author´s elaboration based on Pew Research Center (2022)

In sum, China’s once-attractive investment landscape has shifted significantly in recent years, as evidenced by a significant slowdown in GDP growth, a contracting real estate market, rising domestic debt levels, and mounting international political tensions, most notably the ongoing trade war with the United States. These issues have resulted in a historic exodus of investors, with foreign investment as a percentage of GDP reaching a 25-year low in 2022. This combination of events has created a tough environment for investors, causing many to reconsider their involvement in the Chinese market. Furthermore, concerns about transparency and legal protection, as well as China’s shifting political and regulatory landscape, have eroded trust in the country’s leadership. As a result, Western countries are rethinking their relationship with China, and the future of China’s investment landscape is uncertain.

[1] Associate Professor in the Faculty of Economics at Universidad Externado de Colombia and holds a PhD in Government from the University of Essex (UK). tatiana.gelvez@uexternado.edu.co

[2] Student of International Business Management, Centennial College, Toronto-Canada. grimaldosvalerojoel@gmail.com